25 September 2024: As CBL crisis enters its second month, there are few signs of resolution on the horizon

This week we look at the economic impact of the ongoing CBL crisis, as well as UN and US meetings around security cooperation and the arms embargo, and the ongoing oil blockade.

Dear Libya Analysis LLC Newsletter subscribers,

Each week, we will continue to share for free our traditional newsletter content (one article from our Weekly Report on Libya and its overall table of contents, plus teasers and info on our other products) via Substack.

In addition, readers interested in accessing additional Libya content can subscribe to the premium (pay for) version of the Substack which gives access to two additional subscriber-only Libya articles per week, drawn from our Weekly Report. These articles will cover key developments and analysis from that week, whether in the political, economic, security or energy sectors. The premium subscription also gives access to our premium archives.

As CBL crisis enters its second month, prices are rising, the dinar is plummeting and basic goods are drying up, with few signs of resolution on the horizon

Incident: As it stands on 24 September, no further progress has been made on talks between the Hight State Council (HSC) and the House of Representatives (HoR) on one side and the Presidential Council (PC) on the other side to resolve the Central Bank of Libya (CBL) crisis.

Informed sources indicate that the crux of the issue is around the PC’s refusal to remove its 18 August decision which saw the new CBL management appointed, and the HoR’s refusal to negotiate with the PC until this condition is met. If the PC concedes it did not have the legislative authority to issue that decision, then it is also conceding it does not have the authority to remove the HoR and HSC (which appears to be its longer-term aim) and would likely be consigning itself and the Government of National Unity (GNU) to irrelevance. Similarly, if the HoR and HSC agree a deal where the PC decision is not removed, they could be seen as recognising the authority of that move and thereby opening themselves up to further legislative challenges from the PC in the future.

UNSMIL has reportedly invited the HSC, HoR and PC representatives for further talks to resolve the crisis on 24 September, though there is no further information about this at the time of writing.

The narrative battle has continued this week over the state of the CBL and the Libyan financial system since Libya was effectively shut out of international systems one month ago.

In a tv interview on 17 September, evicted CBL Governor Sadiq al-Kabir warned that Libya could be forced into an ‘oil-for-food’ barter scenario - as seen with Iraq in the 1990s – if the CBL crisis remains unresolved.

On 18 September, the PC- appointed management of the CBL issued a statement in response to ‘misleading news and baseless rumours’ around the financial statement it published on 13 September. This presumably refers to a statement by Kabir on 16 September in which he refuted many of the points in the statement and accused the new management of acting outside of their jurisdiction, for example over extinguishing the public debt ‘at the stroke of a pen’.

The PC-appointed management stated that it has sufficient resources to offset the public debt and confirmed that all accounts, including tax fees and reserves, remain as they are in the records, and no accounting restrictions have been taken regarding them. In addition, it said no balances have been transferred from the CBL, calling on the regulatory authorities to review the records and systems to verify this information. The statement called on the media to show a sense of responsibility and not to publish misleading news, stressing the need to carefully investigate information from its primary source through the CBL's official platforms.

The economic impact of the ongoing crisis is being increasingly felt amid shortages of basic imports, rising prices and the falling value of the dinar.

HoR Speaker Aqeela Saleh has warned that the exchange rate could rise to over 10 LYD to 1 USD in the coming period unless the CBL crisis is resolved. He added that the crisis will impact development projects and that it will take time for Libya to regain the trust of international financial institutions following the resolution of the crisis.

On 22 September, the value of the Libyan dinar in the black market dropped further against the US dollar, reaching over 8 LYD to 1 USD. It had been around 7.6 to 1 USD the week before and the official rate is around 4.74 LYD to 1 USD. The rate for 50 LYD notes is reportedly around 8.4 LYD to 1 USD.

On 22 September, the GNU Minister of Economy Muhammed al-Huweij gave a press conference in which he reassured citizens that Libya has a strategic reserve of all basic materials sufficient for three months. He called on all banks and merchants to activate their bank credits saying ‘All credits will be opened during this week according to the information available to us.’ He also called on the regulatory authorities to monitor prices and prevent speculation in the dollar.

On 23 September, the World Food Program published its Libya Market Price Monitoring Report for August, showing a sharp rise in prices in the Libyan market coinciding with the banking crisis and the closure of oil fields. In the western region, prices rose by an average of 4.2% from July bringing the Minimum Expenditure Basket (MEB) to 956.39 LYD, though specific locations such as Misrata, Zuwara and Zawiyya saw rises of 9 – 10%. In the eastern region prices rose by 2.5% to 924.84, and the southern region rose by 1.3% to 975.42 LYD – the southern region remains the most expensive region, impacted by conflicts and military mobilisation at the Ghadames and Debdeb border crossings in August. Overall, the report noted that average prices are 17.8% higher than at the start of the year, and it seems very likely that prices in September will show further significant increases.

Comment: The last UNSMIL-mediated talks to resolve the crisis concluded on 12 September with UNSMIL saying that despite some progress, the HoR and HSC had failed to reach a final agreement. Meanwhile, Menfi has been pushing ahead with efforts to form the National Commission for Referendum and National Inquiry, following its initial establishment of the commission in August. It seems the aim of this new commission is to hold a referendum on whether the HoR and HSC should be dissolved given their failures to complete their duties over the last decade. The HoR has stressed the PC does not have the power to set up such a commission. On 13 September, the PC-appointed CBL leadership released the CBL monthly statement of accounts covering 1 January to 31 August 2024. It said that the public debt recorded in its books had been extinguished and has become ‘zero’.

The Iraq oil for food programme occurred under different circumstances to those in which Libya currently finds itself. Iraq was bankrupt and faced sanctions and a humanitarian crisis post-Gulf War, necessitating UN intervention. The Oil-for Food Programme allowed Iraq to sell oil on the world market in exchange for food, medicine, and other humanitarian needs for ordinary Iraqi citizens. In Libya’s case, the CBL is not facing any sanctions, nor is it short of foreign exchange reserves. Instead, Libya’s dollar reserves cannot be accessed nor most USD transactions carried out due to the uncertainty around the CBL leadership (and the associated risk of how the funds will be used and by whom).

Significance: The crisis over the CBL leadership and lack of access to USD accounts and transactions has now been going on for a whole month, with the political and economic impacts becoming increasingly severe and more difficult to rectify. On the international front, although many international banks have suspended transactions until the situation is resolved, there have been no sanctions or threats of sanctions against the assets of the key Libyan actors responsible for prolonging the crisis. Despite efforts by UNSMIL to revive talks and various interim solutions being touted, a solution looks unlikely to be agreed in the immediate term, and could remain elusive in the longer term as well. At this point, even if some sort of resolution is agreed, it is very unlikely that Libya’s economic and financial systems can just revert to where they were before the crisis. The break down in trust and the uncoupling from international systems is likely to have long-lasting effects and it is unclear how this will be overcome. The political status quo is also likely to shift, spelling greater uncertainty and the potential for an intensified struggle for political dominance among the Libyan elite and their international allies.

On the domestic front, the Libyan elite appear to believe they have more to gain, or less to lose, by holding out, with the PC, GNU HoR and HSC worried that any capitulation would ultimately spell the end of their power and/or their easy access to state funds - the only probable winner in any scenario is the Haftar family, who have multiple avenues through which they can secure access to funds and power. As such Libya’s status quo actors have been willing to let the crisis continue for an entire month, despite the increasingly negative, and likely long-lasting, impacts. However, domestic anger and frustration is likely to become increasingly hard to ignore.

Al-Huweij’s statement that the country has 3 months of supplies left was presumably meant to reassure Libyans. However, it is likely to have had the opposite effect, with many people panicking about what will happen after those three months (especially as the import supply chain needs several weeks lead time). This is likely to lead to panic buying and possible hoarding by traders, increasing prices further and driving down the value of the dinar. Although security forces in Tripoli are likely to try and prevent these activities through direct pressure on traders and black-market operators, such actions are unlikely to have the scope or coordination to succeed. The oil blockade is also likely to remain in place for the foreseeable, further diminishing oil revenues, fuel supplies and power generation. It is likely that as the conditions worsen and public anger grows, the pressure on the elite to reach a deal will grow. However, it does not seem that pressure is sufficient yet for the elite to reach an agreement that can end the crisis – or at least stop it from worsening further.

Covered in our Premium Version:

Koury visits IRINI HQ stressing the importance of the arms embargo on Libya; US delegation discusses security cooperation with Dabaiba and Haftar

Incident: Acting UN Envoy to Libya Stephanie Koury visited Italy this week, including the HQ of Operation IRINI, stressing the need for the arms embargo to be enforced. On 18 September, Koury visited the Headquarters of EUNAVFOR MED Operation IRINI, located in southern Rome. She was welcomed by the Deputy Operation Commander, the French Rear Admiral Guillaume Fontarensky, who briefed her on the tasks of Operation IRINI, current operations and challenges. The Admiral emphasized that IRINI is the only international actor implementing the UN arms embargo on Libya. He said that through its use of ships, aircraft, drones, and satellites, the Operation provides continuous surveillance in the Central Mediterranean, monitoring air and sea lines of communication, particularly on high seas off the coast of Libya, 24 hours per day, 7 days per week.

Partial oil blockade continues, as do reports of Arkenu exports; NOC seeks to shift blame over fuel shortages

Incident: The Libyan production and export situation in the context of the ongoing blockade has not changed much since last week. According to tracking data by Argus, Libya has exported around 389,000 bpd of crude so far in September, a sharp drop from over 930,000 bpd in August before the oil blockade. On 23 September, Argus set Libya’s current overall production at about 500,000 bpd, a slight increase from previous Argus estimates of 300,000 bpd last week. Meanwhile, reports that the Benghazi-based oil company Arkenu Oil Company is exporting crude outside of the NOC’s auspices continue to circulate.

For more...

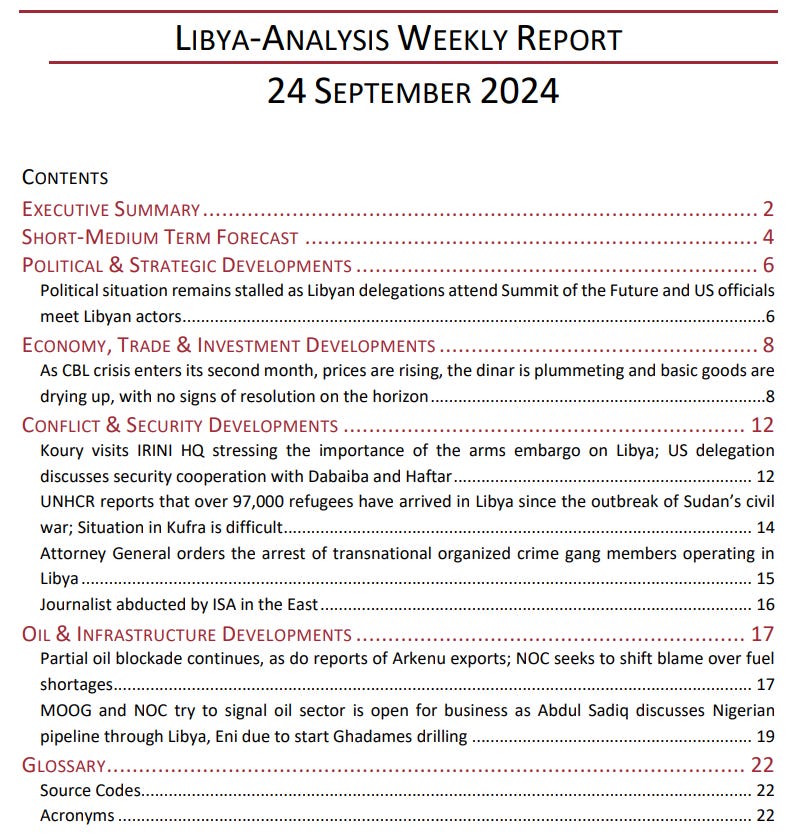

The contents page for this week’s Libya-Analysis Weekly Report is set out below:

If you are interested in subscribing to our Weekly Report and would like to receive more information about the product, please contact Rhiannon Smith, Managing Director, at Rhi@Libya-Analysis.com.

Spotlight on... Due Diligence & Advisory Services

We offer discreet due diligence services to our clients, drawing on open-source and human source intelligence to provide detailed background and business intelligence on actors and entities operating in the Libyan space, helping our clients mitigate their legal and business risks. We also provide bespoke advisory services to meet our clients' needs.

We have also just launched a weekly substack for our non-profit sister project the Libya Security Monitor (LSM) which you can access here.

For more information, please contact Rhiannon Smith, Managing Director, at Rhi@Libya-Analysis.com.

From our Blog..

On 20 September, Al Jazeera published an article by Simon Speakman Cordall, titled ‘Diplomatic failings and ‘elite bargains’ prolonging Libya turmoil: Analysts’. Cordall speaks to several analysts about the...read more

To read our other blog posts, click here.

About Libya-Analysis

Libya-Analysis® helps clients understand Libya. We are a boutique consultancy with years of experience producing nuanced, evidence-based research, analysis, and forecasting on Libya. Our strategic insights are used by multinational companies, international organisations, and democratic governments to make sense of the latest political, economic, commercial, and security developments in Libya.

Koury visits IRINI HQ stressing the importance of the arms embargo on Libya; US delegation discusses security cooperation with Dabaiba and Haftar

Keep reading with a 7-day free trial

Subscribe to Libya-Analysis to keep reading this post and get 7 days of free access to the full post archives.